Asset Portfolio optimization is based on Modern Portfolio Theory (MPT), which is based on the investment principle that investors want to obtain the highest return with the lowest risk. To achieve this goal, an optimal MPT-based portfolio needs to be highly diversified to avoid crashes when a particular asset or asset class underperforms, and to select assets with as low a correlation as possible.

The modern asset market is becoming increasingly dynamic. Market participants who manage asset portfolios need advanced optimization decision-making mechanisms to help manage asset portfolios in order to achieve expected returns. Relying on our advantages in optimization decision-making modeling, we can provide asset management institutions with customized portfolio optimization system models to enrich the optimization decision-making mechanism of asset management institutions.

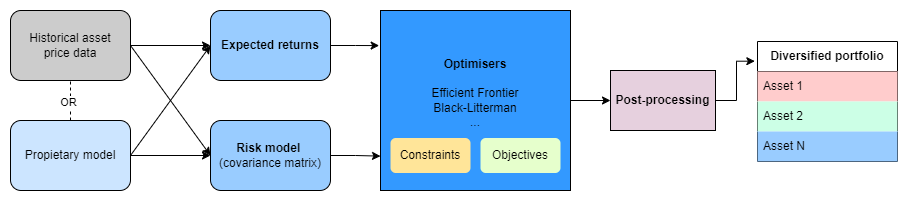

Our asset portfolio optimization services is shown in the following figure:

A typical portfolio optimization customization include:

- Expected Return Estimation

- Risk estimates (e.g. covariance of asset returns)

- The objective function to be optimized

- Optimizer (IBM ILOG optimizer is recommended)

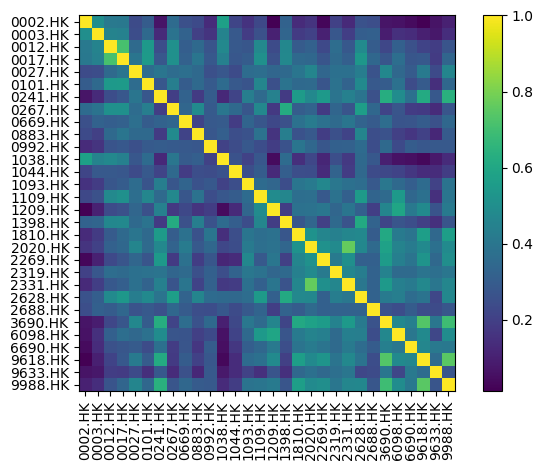

For example the covariance between different assets.

The better covariance matrix with shrinkage, which reduce the extreme values in the covariance matrix.

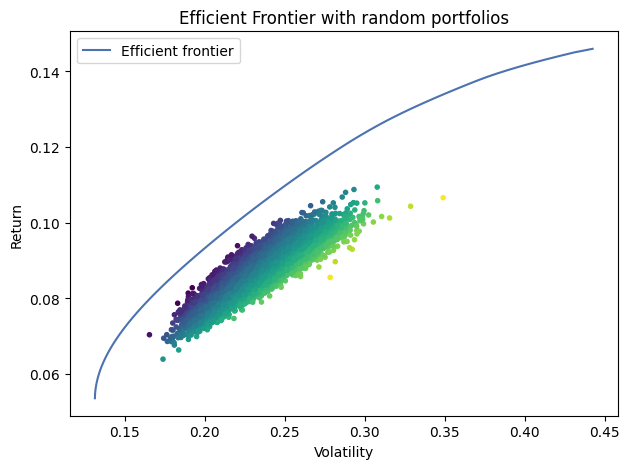

Also the efficient frontier, it can generate the classic efficient frontier with random portfolios, help asset manager to grasp the most like results look like.

Thre are more functionalities coming for user requirements, but the key success factors to customers are:

- analyze the economic events on the risk of the portfolio continuously.

- improve portfolio structure to balance the risk and revenue generating.

Comparing other similar portfolio analysis tools, our solution and service are more flexible to adapt to your business environment, and keep your secret optimization within your control.

More information on our portfolio optimization customization solution, please contact us.